The Dominance of Uniswap v3 Liquidity

May 05, 2022 | Gordon Liao, Dan Robinson

New research published today shows that Uniswap Protocol v3 has deeper liquidity in ETH/USD, ETH/BTC and other ETH pairs than leading centralized exchanges. This research demonstrates that AMM market structure – which is largely crypto-native today – can surpass order-book exchanges and transform traditional financial market structure to be more liquid, stable, and secure.

The complete research report and our open-sourced methodology are here (and in pdf form here), and we are making our code and data freely available. In summary:

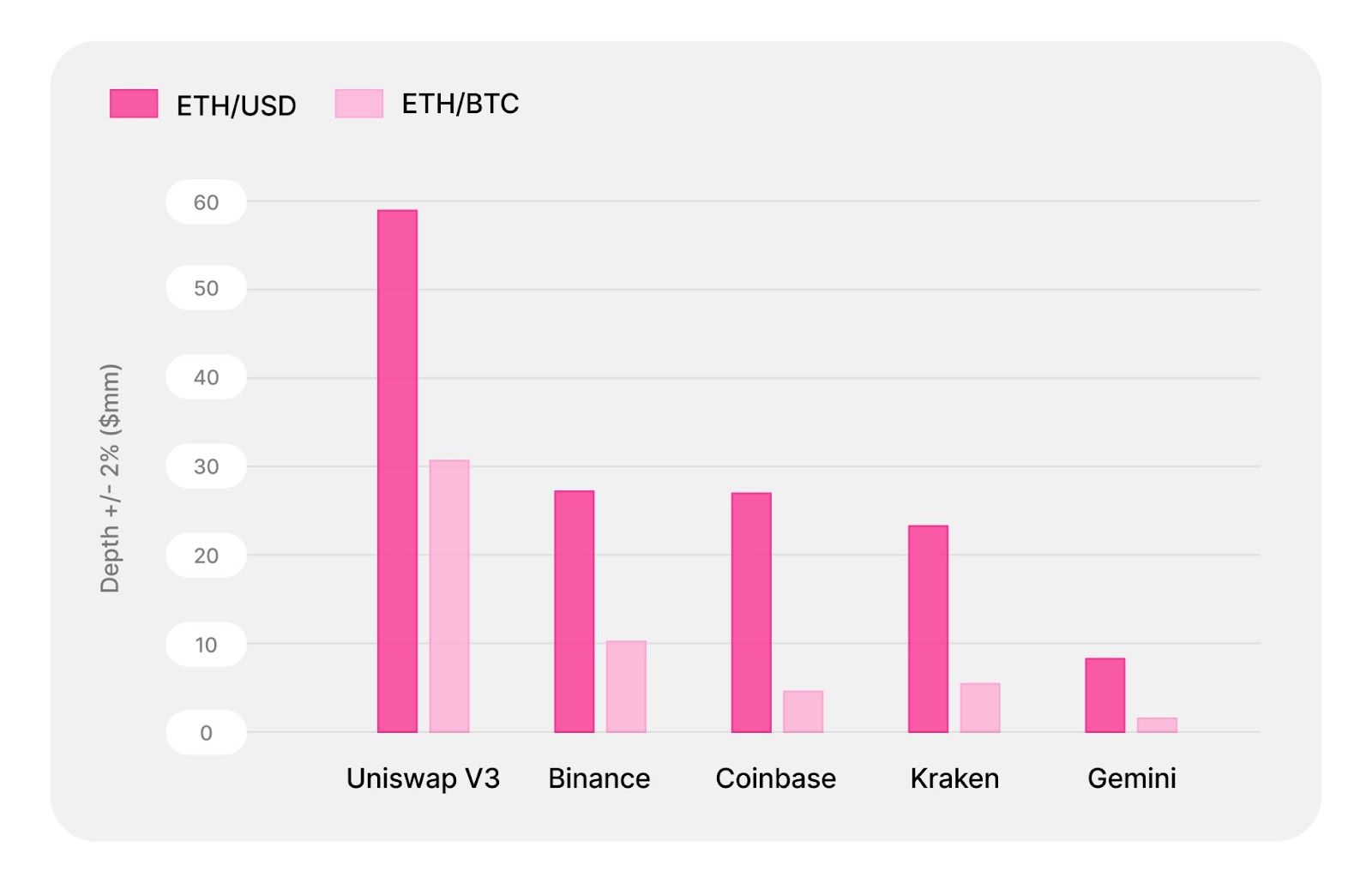

- For ETH/USD, Uniswap has ~2x more liquidity than both Binance and Coinbase.

- For ETH/BTC, Uniswap has ~3x more liquidity than Binance and ~4.5x more liquidity than Coinbase.

- For ETH/mid-cap pairs Uniswap has on average ~3x more liquidity than major centralized exchanges.

Market depth comparison for ETH/USD stables and ETH/BTC

Note: The figure shows the daily average +/- 2% spot market depth in $millions for the sample period from June 2021 to March 2022 for ETH/USD and February 2022 to March 2022 for ETH/BTC. The market depth for ETH/USD is aggregated across ETH/USD (fiat), ETH/USDC, ETH/USDT, and ETH/DAI. Data on centralized exchanges is provided by Kaiko. The comparison does not include some exchanges, including FTX and Bybit, due to a lack of data.

The research also finds that many stablecoin pairs have much more liquidity on Uniswap v3 than centralized exchanges. For USDC/USDT, Uniswap v3 has about ~5.5x more liquidity than Binance.

Uniswap v3 also has higher market depth across all price levels, which means it’s even more advantageous for users to execute larger trades on Uniswap v3 relative to centralized exchanges. For an ETH/dollar trade size of $5mm, for example, the savings would be around $24,000 given the expected price impact difference. (For $5mm notional, the average price impact is roughly 0.5% on Uniswap v3 and 1% on Coinbase. The fee is about 2 bps lower on Coinbase on average.)

Traditional market structure is dominated by a few market makers. But easy liquidity creation (AMMs) dramatically lowers the barrier to create and participate in markets. This unlocks new and existing forms of value for communities and individuals.

We look forward to sharing more research with you!

Disclaimer: This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. This post reflects the current opinions of the authors and is not made on behalf of Paradigm or its affiliates and does not necessarily reflect the opinions of Paradigm, its affiliates or individuals associated with Paradigm. The opinions reflected herein are subject to change without being updated.